It’s so much fun talking about how to become empowered in your business, how to become an unshackled owner, how to own your business, not have that business own you, and how to build an asset that works harder for you than you have to work for it. That’s what we’re doing here on The Unshackle Owner podcast. That’s the kind of guest that I bring on when we bring on these brilliant people. I want to give you a little peak into their story, into their thought process, into what’s made the difference for them to not only make money, but to have a life that they love and one that gives them opportunity to explore all kinds of other interests or focus like a laser beam on the one thing they’re awesome in their company and not have to do a bunch of stuff that they are crummy at doing. That’s what unshackled means to me. It means doing what you love, not having to do other things you don’t want to do, working as hard as you want and then being able to unplug and go do what you want when you want to do it. That’s unshackled.

It’s so much fun talking about how to become empowered in your business, how to become an unshackled owner, how to own your business, not have that business own you, and how to build an asset that works harder for you than you have to work for it. That’s what we’re doing here on The Unshackle Owner podcast. That’s the kind of guest that I bring on when we bring on these brilliant people. I want to give you a little peak into their story, into their thought process, into what’s made the difference for them to not only make money, but to have a life that they love and one that gives them opportunity to explore all kinds of other interests or focus like a laser beam on the one thing they’re awesome in their company and not have to do a bunch of stuff that they are crummy at doing. That’s what unshackled means to me. It means doing what you love, not having to do other things you don’t want to do, working as hard as you want and then being able to unplug and go do what you want when you want to do it. That’s unshackled.

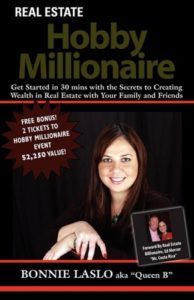

Our guest today, Bonnie Laslo is a great example of someone who’s built a life and a business that not only serves her and creates value for her and her personal life, but also for lots of other people who are willing to listen. Bonnie got into real estate young, she says that she was financially free by the time she was 23 years old. When I was 23, financially free didn’t mean a lot of money. Just a couple of years later, she was, I think by 26, was a millionaire and has been just expanding her net worth all that time. She’s the founder of Hobby Millionaire, which is a great program that, full disclosure, Laughlin Associates, one of my companies, is now working as affiliates with Hobby Millionaire, sharing the knowledge of both of our organizations with our memberships, our client base. Bonnie and I do have a new and growing relationship. I needed to get her on the podcast so you guys could learn about not only how she got wealthy and successful at a young age, but how she’s taken that and taught thousands of people how to do the same.

Listen To The Episode Here

Hobby Millionaire, How To Be Financially Free with Bonnie Laslo

Bonnie, welcome to The Unshackled Owner podcast.

Thank you for having me.

It’s a pleasure. Tell us a little bit about your story. How did you become financially free at 23? How did you come to understand what that even meant? I don’t think I was thinking those thoughts at 23, let alone understanding that I was there. Share a little bit about your backstory and let’s learn a little bit about how you got to where you are.

Unfortunately, it wasn’t one of those epiphanies of, “I want to get this done and be productive,” and that kind of thing. It was more out of necessity, unfortunately. I was in college, I was there on scholarship. I could not make my rent. Being a student, struggling and taking full time classes, being there on scholarship and trying to find time to work but also cover your housing cost. I couldn’t make my rent, didn’t really like asking parents for money. They didn’t necessarily have a lot of it either. As funny as this may sound, I listened to that late night infomercial called Carleton Sheets. They were doing a special for $9.99 a month. I remember going, “Okay.” He says I can have my own place and I can live in one of the bedrooms and I can rent out the other three rooms or something to friends and then I don’t have to worry about getting evicted or not having money for rent and covering those housing costs. That’s pretty much how I first got started, that late night infomercial and the fear of being homeless. Whenever you’re going to school to get a degree and stuff, that’s hard enough, versus worrying about having housing. That was my necessity story.

Isn’t it interesting how much great stuff, that leap of faith, that moment when you had to get entrepreneurial comes out of necessity? It does come out because, “I went to school and took a bunch of entrepreneurial classes.” It’s because all of a sudden your back was against the wall and for whatever reason, you felt like you had to take unusual steps. Carleton Sheets, if I remember correctly, was the one always standing in front of a mansion or a yacht, isn’t that right, sitting by the pool?

Yeah, that’s him, that late night infomercial. I think that I’m probably in the 1-3% that actually ordered the program.

What did you do? What was your first step? You said you needed a place, you want to make sure your rent covered. It sounds like you were a little bit ahead of Airbnb, or Carleton Sheets was. Say, “Rent a room, rent a couch.” Tell us, how did you go from a $9.99 monthly subscription to actually doing your first real estate deal?

I ordered the program, it was summer. I had the summer session to pretty much figure this out. I’m like, “$10, I can afford that. Let me give this a whirl.” I started reading, I started doing exactly what it was telling me to do. It started talking about how you don’t necessarily need money to get a place. I actually found, they call them kiddie condos, it’s a four bedroom, four bath property. Then I looked at the financing that was required there. I just pretty much asked people. Whenever it came down to it, it was only a few thousand dollars down for me to get into this. I did go back to my father and I asked him, “I know you don’t have the money to help me with this, but would you be able to at least cosign?”

Finding out what resources I currently had or could create from other people to be able to find a solution for myself.

I remember, I pre leased out the rooms, the other three rooms in the condo that I would be living and then I used some of my scholarship money and grant money to actually use for the down payment. Got into it, no money down in essence from the aspect of my out of pocket money. It was all from other people per se. Then that would cover pretty much my housing. I remember, I had $80 left over a month to be able to use on food and ramen noodles and pizza at the time. I remember going to the grocery store with a calculator. That was pretty much the first tool that I had, which is finding out what resources I currently had or could create from other people to be able to find a solution for myself. It worked out. That was my first one.

It was a condo, you are buying it, you weren’t leasing it and you are pre selling the other rooms to other people.

That particular one, yes. I bought it. I got the kiddie condo for him to cosign it and then used the down payment money to actually get into that deal, between the scholarship stuff and the first month’s rent and security deposit, things back in the day. There was something interesting that happened whenever I did that, which was in the future, speed ahead a little bit, at the time, people were also graduating at the same time. I’m a young college student, no income because I’m going to school, yet I was able to lease out the neighbor’s condo because they were leaving to go for a job in California. They couldn’t sell them because they were all on the market at the same time since everybody was graduating. I was able to rent those ones at $750 I remember, and I rented out each of the bedrooms for $350 a month.

You doubled your money. You got 100% return by being the leasing agent of somebody else’s property.

I actually rented it from them. I actually did what’s called an option on it. I rented the condo for $750 a month and I paid them $750, yet I was collecting $1400 and I was taking the spread. That was in college. That was interesting, whenever everyone started graduating, I started doing rent to owns in essence. I would rent it and then sublease the rooms out to other people and take the spreads as a college student.

See, it’s brilliant. Because you were doing it in your own apartment, because you’d gone from being just this coed, but you went and said, “Here’s what I’m doing,” other people said, “She must be smart enough. I never thought of doing that. If she’s willing to take over my payment, we’ll take a risk on her.” You were able to, because you are already in that business, because you had done it yourself and your neighbors were able to see that you were this clever young person who already was buying your own condo, it gave them a level of confidence. But you had to exert yourself and offer to do something that other coeds might have thought was unorthodox, “Why would anybody let me do that?” But sometimes just by asking a question that seems a little bit unusual and things that maybe other people go, “Nobody will ever let me do that,” you’d me amazed at what people will say yes to.

I was amazed that they would let me do it. I understood I was young, but they looked at it as if, “Worst case scenario, if she doesn’t pay me the rent,” then they could evict me. But it was great because I was already renting out the rooms in my own place, I started having all these overflow traffic and it was easy for me to go right next door to say, “I can rent you this room.” It was funny because I started doing it and then I started teaching some of my friends about what I was doing and they started replicating it too and getting the same results. Not everyone, because some of them would just be tenants that would live with me, but also my friends.

We all started sharing each other’s friends and leads to start filling up the different houses and everything. Once you start having that extra income coming in and not having a house payment, I was hooked. If you start renting out the rooms in your house and all of a sudden your mortgage payment is paid for, it’s addicting. I looked at it from the standpoint of, “Yeah, there’s other people in my house, but the money that they’re bringing in to me, I could go and do more fun things out of the house. I don’t necessarily need to stay at home.” I was very fortunate to have had pretty good roommates and everything living with me. Few weird ones, but cost benefit analysis, it’s totally worth the risk.

I love that you started teaching people right away how to do what you’d figured out how to do.

That was a suffering that everyone was having. Other friends couldn’t make their rent either. I wanted no one to feel the way I felt. That’s scary when you’re young and you’re away from your parents.

Don’t a lot of people feel like, “Maybe if I share this information, somebody is going to get ahead of me. All of a sudden I’m making some money in a way I didn’t think I could, if I teach people maybe they’ll steal my idea and I’ll be out.” How did you overcome that kind of a fear?

I never really thought that way in the beginning at all, but I started seeing that with other people for sure. They were advanced investors that I was looking for as mentors that I came across that kind of had that mentality too. They didn’t want to create competition in the marketplace and that kind of thing. I also made a choice too that whenever I was in college, I wanted to have a job that was related to what I was doing. I became a leasing agent over at an apartment complex for student housing. Flexible schedule, I could study in between showings and that kind of thing. But when I was there, I would see the people coming in that had some type of hardship with their health or divorce or whatever it was, they were on the eviction list. There’s more and more of those people coming in. It was worth it to me to share the information and just make sure as many people, if they have the courage enough to give it a whirl, it could stop that suffering.

It’s really great. The reason I bring that up is because, first of all, I’m a big believer in teaching too. In my unshackled owner class, I teach exactly what I’ve done because I want other people to have that same kind of result and that positive result. But so many people are focused on, “If I share this secret sauce that I’ve figured out, I’m going to somehow diminish myself.” That actually hasn’t worked that way for you. The more you’ve taught, the more successful you’ve become.

As many people that will listen to me, I will show them how to do it, and it’s pretty simple. You’re just renting out the rooms in your place or you’re renting out houses so that those spreads can pay for the house that you’re living in. It’s the same thing over and over again. It’s not like you’re learning some new skill. I’ve just been doing the same thing since college. Every bit of it adds up. You’re making at least a minimum of a $200 spread for each house. If you have five of them on the side, which I’ve noticed that five and having an extra $1000 coming in a month, for most people it really becomes real at that time. This little hobby, you’re like, “This is covering my car payment or my house payment.” Now, it’s up to them at that point if they want to take it up to a millionaire status or if they just want to stay comfortable with having it cover the basics.

They’re the ones who made me financially free so I feel obligated for my team and my tenants to have this information.

Whenever I see the light come on in people and they see it then they start teaching other people too, because it’s just contagious to be able to do something so simple as posting an ad and renting out a room or renting out a house and literally changing your life and the life of other people. I teach that to my tenants, how to do that kind of stuff too, because they’re the ones who made me financially free so I find obligated for my team and my tenants to have this information, to have access to it, to have the support to allow them to think that this stuff is really real. Not just me, but we’ve replicated it and being around people that are doing it as well from start to advanced, it’s not a secret. You can see behind the curtain, you can see everyone doing it, it’s just up to you if you’re willing to put your toe in the water.

Let’s go back in time a little bit. You’re a young kid, you’ve got your first place, you were able to do it with other people’s money, Carleton Sheets was your mentor at this point even though he didn’t know it. You’ve got your own place, you’re basically renting other places or doing a rent to own with people who had to get out of dodge and you were still there. You’re starting to make money, you’re starting to teach other people, you’re young, you’re 20, 21, 22, something like that. First of all, was there any scary time during that? Was there ever a time when something didn’t go well and you just said, “Oh my gosh, maybe I’m making a huge mistake,” or was it always just perfect smooth sailing at everything you’ve ever done?

I’ve been fortunate because the stuff that I did was very, very low risk. I remember going to owners of houses that are in really bad shape and just saying, “I know I’m young and everything, but I really can’t make this house any worse.” I would do the painting, I would do the cleaning. I remember going to Home Depot and taking their weekend classes and stuff on how to fix some things. Luckily, I was at the apartment complex so some of the maintenance guys on the weekend, if there is technical things, I could be like, “Can I buy you a six pack? Can you come fix the ceiling fan or this toilet is doing crazy things?” I didn’t have a lot of money, but I would surround myself with people that could help me fix stuff because the things broke and they’re expensive things, that was scary.

If an air conditioning went out, I didn’t have the money to replace it. It would have to be a fix it kind of thing, otherwise I’m getting used window units from the appliance place down the street or asking for, because there is like free cycle, I don’t know if you have ever heard of that. People give out free stuff on the internet and that kind of thing. That was the only scary thing, was if a big ticket item were to come up or did come up, I had to do the repair versus a replacement to handle that situation. That was pretty worrisome. Of course, whenever it’s raining, I’m not thinking, “It’s beautiful and it’s raining outside,” I’m like, “Oh my gosh, is there a roof leaking?” stuff like that.

When did you realize that this was going from something you were doing to a business? When did you go, “I’m going to organize myself and start to find a way to scale what I’m doing.”

I remember working at the apartment and I was doing this on the side. I was very good at the leasing aspect of it. Whenever I graduated, I was like, “I can either stay here and keep doing the leasing stuff or I can go and make more money being a manager at a different property.” I went and I talked to my manager that was there and I told her what I was thinking about doing. By that time, I had already kept them at 100% occupancy for many years. They came back and said, “We’ll match it and we’ll let you stay here, still in second, doing assistant manager leasing stuff.” I opened up my first LLC and I remember feeling proud of that because that’s a real business, a limited liability company. Being able to have logos on my shirt, I thought about what the name would be and that kind of thing.

It really hit when I started doing the taxes for the LLC because there came a point where the income coming in from the business matched what I was making at the apartments. I’m not saying I was making a ton of money at the apartments, because I remember back when it was $4.25 an hour. But I remember thinking to myself, “I could leave this if I really wanted to.” But of course, at that point, you’re addicted to the money of both sides. I was like, “I’m going to use all the money that’s coming in from the business to just keep reinvesting. I’m going to live only on my leasing agent pay.” Whenever I made that decision to just keep reinvesting but continuing to work, that it turned into a business.

You’re going to live like nobody else wants to so that someday, you can live like nobody else can. It’s the Mark Cuban story about building his business and getting the little ketchup packets and eating those because he needed to keep reinvesting and keep building this idea. One of the biggest stumbling blocks that I see when people are getting started in a business is that they start to make a little bit of money and they’ve been struggling for a while, now all of a sudden they’re making a little more where they can go out to dinner or they can go on a date or buy a nicer car or something like that. They immediately step up into living into the new income. Then when they need help, “In order to grow the business, I really need to get that bookkeeper, I really need to get that IT person, I really need to get that marketing help, I need to get that salesperson,” in your case Bonnie, “I need to get that handyman to do the work.” But what happens is they’ve lived into the income and then they feel afraid to hire somebody because it means they have to take a cut in pay. What if it doesn’t work out?

I see people that work their butts off all the time doing the things that they suck at doing because they’re consuming all the money. They’re not thinking of it like a business, they’re thinking of it like a job. Dang it, that’s my money. But the people who make it and who get rich are the ones who live low for a while and reinvest in the business. Bonnie just talked about how not making huge money, but as a young early 20s kid in a college town not only did something unorthodox and got started getting her housing covered and then making a little money, now she’s making as much money from her hobby, she called it, as she was from her job, a W2. But she said, “I’m going to live on my job and I’m going to reinvest.” I had to restate that because Bonnie, I don’t know if you’ve ever seen it, but I see people who thwart their growth by sucking up all of the money that’s coming in, and usually into stuff that’s very short lived, like expensive dinners, drinking, car payments, stuff like that that is not going to help you grow at all.

You have to use the money in ways that they make money.

Correct. I remember the car thing, don’t get me wrong, I wanted to spend the money. When I did splurged on that car, and I remember the monthly payment for that vehicle was $600 a month, I said to myself, “I can only buy this thing if I buy three houses,” because that $200 a month would cover that car payment. Any time I was acquiring these expenditures per se, I made sure that I bought the assets or worked my way into deals that would cover those additional wants. I just played that game with myself, it was that reward. I could only reward myself and do that if I did this. I always would make sure it would be balanced. I was pretty disciplined I guess.

I remember working at the apartments and making $12 an hour. I ended up hiring my best friend because the business side of it started getting really busy. I was paying her $10 an hour. I was working at the apartments for $2 an hour because I was using that money to have a full time person building my hobby on the side. She was actually a tenant at the apartment complex. It was good to be around all the resources and the people and literally at the apartment complex being paid to get trained on how to manage and run a property like that and one day have my own. Then also, being able to help out my best friend to be able to run my business per se on the side and do the leasing for those properties and help me find more properties. You have to use the money in ways that they make money. Don’t kill the goose as they say, you just spend the eggs. You spend the eggs, but don’t kill the goose.

It’s funny. I love that you said goose, I talk about that a lot about you’ve got to make sure you feed that goose that lays the golden eggs before you feed yourself. Go a little bit more into this, tell me about this idea of the Hobby Millionaire, what you guys are doing, what you’re teaching. Let’s illuminate this opportunity that maybe a lot of the listeners just don’t even know is possible. A lot of the things you’re saying right now, I think people are going, “What? You could do what,” or saying, “I need to buy three houses to get $600 for a car payment. That seems like a big investment for a small return.” But explain that to us so we understand it, because you have built a whole huge following around this principle and I want to understand it better myself and I want my listeners to understand it.

Hobby Millionaire pretty much is a group that I started meeting up with and started having people coming to Mastermind and talk with each other specifically about real estate. I was unaware that people were not doing the type of real estate investing that I was doing until the market took a crash and everyone was freaking out because their values were going low and then I also had some other business partners or other friends coming back and saying that they’re negative cashflow and they’re going to lose their houses and all this kind of stuff. I took a look at what they were doing and they were doing new construction, they were doing deals where they were banking on appreciation and all of these other types of investment things.

The stuff that I do is pretty much like recession proof real estate. It already has equity whenever you purchase it because we’re buying properties that are literally $100,000 and below and if you get above that you got to get into multifamily, to where you’re into doing duplexes or quads or doing apartment complexes. Anything higher than that really isn’t a normal property. Whenever you buy the property and you’re fixing it, I remember getting a credit card, my first Discover card in college, I got a hold of the properties where people would rent them to me and then I would use my credit cards and everything to get the supplies to make them ready to be rented. But every single property has a minimum of a $200 profit margin and is a ten cap. Every single property that I did always met those two benchmarks.

That’s what I teach the Hobby Millionaire group, is the Bonnie Benchmark, which is the $200 benchmark and a ten cap. Otherwise, you don’t touch it. That’s going to allow people to grow it faster that has enough spread in it too whenever you don’t have any money and you want to bring a partner in, someone who doesn’t have the time but they have the money, but you have the time and don’t have the money. It’s a partnership that works for both sides and you’ve got plenty of cashflow there to make the money that you’re looking to make. It’s also a deal that when lenders look at it or people that are looking to loan money on it, they look at and they’re like, “This is a solid deal and it makes a lot of sense.”

Give us an example of a deal.

For instance, a house that’s purchased for $50,000 and maybe it needs $10,000 to make it rentable and made ready, and then turning around and renting it out at $1000 or $900 a month.

Are you buying it outright or you’re financing that through a bank or through a private lender?

All of the above. However you can get a hold of it. Let’s say that you can’t do either of those things, then I’m going to go to everyone who has a house that is roughly in the $50,000 range and I’m going to say, “Can I have the opportunity to buy this house at that $50,000 in three to five years? Right now, I’m willing to pay you $500 a month. It’s not habitable, I know that no one can go in it, but I’ll do the fixings. Aaron and I could pay you $500 a month and turn around and rent it to someone for $1000 and spend some money on a credit card to get it going or bring in a partner,” that kind of thing. But what happens is once it’s rented for $1000 a month, then you can go back to the lender and pull all the money back out and just do it over and over and over again.

What happens if somebody doesn’t have great credit or they’ve had a bankruptcy? How does somebody start doing something like this?

Then you can find a partner that has good credit. We teach credit repair on how to fix those challenges. The people that are in the Hobby Millionaire group, some of them don’t have great credit, so what I’ve done with them is now that the tables are turned, I will give them a lease option. I’m allowing them to be a renter and they go ahead and pay that monthly rent and then they’re getting the property ready and everything and then they’re going to rent it out to their subtenant in essence and they’re going to be taking the spreads.

You become the bank, you make a margin with the deals good enough that you both can make money on the deal.

Yeah, because everything is literally $100,000 and below, $50,000 and below. We even have houses that start off at $32,000 and you’ve got deals you can get into for as little as $5000, $3000, $10,000, $15,000 all day long.

Wow. You don’t need a ton of money to get in this business and then you start to make the spreads and you start to build an asset base. Before you know it, you’re desirable looking because you have this great portfolio of just solid deals. It’s not high risk, it’s just a lot of people think they don’t want to touch these places that are maybe in a less desirable city or less desirable neighborhood or they don’t want to get their hands dirty or they’re afraid that they wouldn’t know what to do with it. As you showed as a young kid in college, you can fix the toilet, you can go to Home Depot and learn a class on how to rewire a light fixture, you can do it.

We didn’t even have YouTube back in the day. Now, everything is at everyone’s fingertips and everyone can get into this game no matter what, if you’re a startup or advanced. You can pretty much get in there and just get the job done. The cool thing about it though is whenever you’re buying this way or you’re doing deals this way over and over again and throughout whenever the market went down, it was amazing because we made more money during that timeframe. Because then all the rental properties that we had that had tenants in them, then people have down payment money to do options and then you could sell the options and everything to the people that were downsizing. I say, “Are you sure you don’t want to stay in your house and figure this out and do this?” They’re like, “No, just give me a different house. I have $5000 or $10,000 down that I could put towards it so we can have our home, but one that’s not twice the value or underwater or something.” We would reinstate their loans, fix them up and then resell them or fix them up and rent them. It was a win-win for everybody.

The crash really opened up, while it hurt so many people from their value and what they thought they had accrued just in this appreciation in a bubble market, even though home ownership went down, renting went way up and rentals, which used to be kind of the stepchild, it’s better to own a house, the rentals got more expensive than the house payments but you couldn’t afford the money to get into a house so you rent it. People who had rentals cleaned up during their recession, did really well during the recession.

It was very easy to rent.

Now folks, we’re in an economy today, we’re in an environment today where people don’t go to work at the factory or the white collar company for 30, 40 years and wait for their pension. We have a very transient population, people change jobs often and move around often. There’s a shrinking number of people that actually want to buy a house on a 30 year fixed mortgage, pay it off and then are there for 40, 50 years. That’s a unicorn at this point. You don’t see that, but what you do see is people that want to rent, they want to rent something and they want to spend their money on other things. They’re not saving for a down payment.

I would think Bonnie, that people who can acknowledge that this is happening in the world right now, in the United States especially, they can make a lot of money by buying the house that somebody wants to get out of and renting it and trying to keep that renter in there two, three, five years and just building equity in the asset. Is that basically the premise?

You’re always always buying something that cashflows, you can always sell cashflow if you needed to.

Everything is based on cashflow. Just like a business or commercial things, I teach everyone to make sure that the house is pretty much only worth the amount of rent you can get for it. If it’s more than that, then fantastic. Every time you’re getting into something, it always cashflows for you, it’s always making over 10% return, if not, higher. We’ve been lucky to average well over 20% to 100% returns and those are all documented with the Hobby Millionaires that are doing their stuff. Whenever you’re taking over other people’s payments and stuff too, you’re safeguarding them from foreclosure and then you’re fixing whatever was broken to just go ahead and sell it for them at that time, then their credit is kind of better and you’re safeguarding that from ever being a foreclosure on their record. At the same time, you’re providing housing for other people that don’t want to buy. You’re always, always, always buying something that cashflows so that if push come to shove, in the future it doesn’t go up in value, you can always sell cashflow if you needed to.

That’s a tip, guys. Write that one down. You can always sell cashflow. Bonnie, first of all, you and I are just getting to know each other. I loved watching you. You’re this very interesting combination when I watched you, observed you at this business conference we were just at. You have this good, lovely, kind heart. I see you mentoring people and helping lift people up, but you also have that look in your eye of, “I know exactly what I’m doing, don’t try to screw around with me. I’ll tell you how it is.” It’s somebody who’s fully in your power, I love that. It’s exciting for me to be building a relationship with you.

Let’s talk about a few things just to help the people that are listening get a few quick little answers to things that might help them. First of all, do you have a book that you love or that you would recommend everybody read. Of course, you have your book called the Hobby Millionaire. But is there something that you would recommend people read or study that would help them get the confidence or get the tools that they need to become a hobby millionaire?

Real Estate Hobby Millionaire by Bonnie Laslo

Hands down, The Millionaire Mind by T Harv Eker. That was a great book that I found very helpful. It’s a tool and it even have functions and everything. When I was having challenges with other hobby millionaires with pulling the trigger or getting stuck in preparation paralysis or just to understand myself better of what was going on and what I was going through because you’re always a growing mechanism all the time with figuring things out for yourself. That book really explained a lot of things for me and it has helped transition people from being stuck to actually taking action, getting things done and really coming into a point of decision making and power of saying, “Look, I know why I’m doing this now and I’m going to get it done. This is why.” That was a very helpful book for me. I hope it will help other people since it seems to be replicating through the group and everything. I like that one a lot.

A great book. Of course, it spawned a whole huge industry with peak potentials. That’s become its own juggernaut. I think you’re right, a great book. It launched Harv’s career really in a significant way. What about a quote, is there anything that you live by or any kind of a credo that really stands out for you?

It’s actually the quote that I had made up. It’s, “Time is valuable, teams are best. Use them both wisely and I will show you success.” That’s my quote I’m leaving to the world.

I love that. Write it down, plaster it on your wall, tattoo it on your eyelids, do something, make sure you learn it. I know that we’re a product of our life’s experience and we’re grateful for where we are now. The fact that you’re on the show means you’ve reached the level of success, that you’re doing well and you’re life’s experience up to this has brought you to this point. I like to share ideas with people so they can avoid pitfalls, they can avoid trouble. Knowing that you are who you are because of what you went through, don’t tell me, “I wouldn’t change anything because it made me who I am.” What I want to know is if you could go back and if you could redo something, if you could’ve done something differently at a different time in life, what would that have been so we can help people avoid those mistakes?

I would say choose your partners wisely. Yes, you go through hardships so you can teach and help other people to not follow on the same footsteps, but if you’re literally buying property with other people, make sure that you know who they are, you guys have met a few times or you both have the same goal in mind and just get really crystal clear on that. Because you don’t want to end up losing everything that you built to a bad partnership or to building a foundation of portfolios and your financial wealth for you and your family just to have that taken from you, that kind of thing. It’s very necessary to do them, it’s just do them wisely and make sure that you know who you’re doing business with and check their credibility and stuff.

Great tip. Partnerships can be fantastic or can be horrible. They can really wipe you out. Choose your partners wisely. In real estate, you might have lots of different partners that you work with on different projects. Just because the money is there doesn’t mean you necessarily jump into bed with somebody. I think that’s a fantastic tip. As we start to wrap up here, what I’d love for you to do first of all, is just to tell us how we can reach you, how can people learn more about Hobby Millionaire, how can they learn more about Bonnie. If they wanted to talk to you or ask you a question or maybe they want to become a Hobby Millionaire and they want to know how to do it, what’s the best way to reach you? After that, what are some parting wisdom, guidance that you could share with people?

If people want to get ahold of me, best way is to actually text message, text messaging directly into the office line, which is 352-226-3535. Or you can also email us at Team@WinOrganization.com. Just in general, if people want to get involved and do this and really make a difference in their lives, get educated, take some knowledge, get to your nearest club and start building those networks and learning a lot. Because granted, people can always fly out here, we have a group out here in Charlotte at the moment so they can fly in and we have our meetings pretty much the second Thursday of every month. But just calling, getting more information, finding out how you can do it for yourself, because this will change your life.

Over 90% of such millionaires in the world are through real estate. This is a sector of your life and your business that you have to learn and learn how to do it properly, do it at very low risk where it’s not going to do anything but improve your life and the life of other people. Make sure when you learn it and you get yourself handled, that you pass on the information to everyone else. They’re already going to ask you how you’re doing it. You can toot your own horn and show them how to do it. Once they start replicating it, that’s the fire. When you start being able to create other people results and putting money back into their pocket just the way that you did it and you just pass that knowledge on.

It’s the old Zig Ziglar, “You help enough people get what they want, you’re going to get what you want.” First of all Bonnie, thank you for being here. I really appreciate you being here. People, you can build wealth. You don’t have to do it in one channel, you can have multiple channels. As you get a little bit of success in one thing and you’ve got a little bit of money, now take it. I love the way that Bonnie has named it, it’s a Hobby Millionaire. You don’t have to be a full time real estate investor, you may turn into that, but you can start out as a hobby, start out finding that 10% profit margin, find out about how you can make a few extra $100 per asset that you buy, find out how you can subsidize the lifestyle things that you want by adding new streams of income to your life.

These skills, these tools, this consciousness of being aware that this stuff is even available to you is what will lead you to becoming an unshackled owner. That’s what we want for all of you guys. Bonnie, thanks for being with us. We look forward to visiting with all of you, share with your friends, like, comment. Let’s get involved, let’s build a movement, let’s follow Bonnie’s example and share this information with everybody we come in contact with. I’ll see you next time right here on The Unshackled Owner podcast.

Links Mentioned

- AaronScottYoung.com

- The Unshackled Owner Twitter

- The Unshackled Owner Facebook

- Aaron Scott Young LinkedIn